The Malta Budget 2024 appears to be a constructed response to the prevailing economic climate, balancing caution with social awareness. It demonstrates an awareness of the immediate needs of the population, particularly in terms of living costs and education, while also laying down a foundation for longer-term economic stability and growth. However, the lack of robust measures to address declining fertility rates and a cautious stance on capital projects may defer some pressing challenges to the future.

In essence, the budget reveals a government striving to maintain economic stability and social cohesion in a time of global uncertainty. The effectiveness of these measures, in the long run, will depend on their execution and the global economic landscape’s trajectory, posing another test of resilience and adaptability for the Clyde Caruana’s time as finance minister.

Fiscal Outlook of Malta Budget 2024

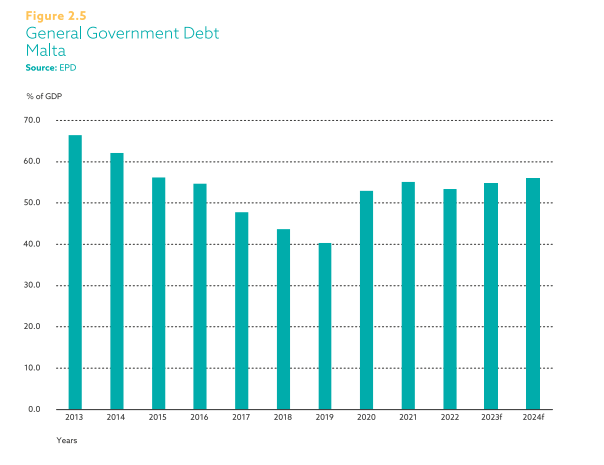

The 2024 budget is deeply determined by the country’s current economic trajectory. In 2023, the total debt-to-GDP ratio stood at 55.3%. For 2024, the Government is targeting a deficit of 4.5 percent of GDP. The deficit reduction in 2024 is expected to be driven by a sustained growth in tax revenue while Government expenditure is expected to increase by less relative to GDP growth. The debt-to-GDP ratio is healthy and well below the 60% Maastricht criteria. However, a cautious monitoring of the annual deficit remains important.

Similar to most countries who sought to shield their populations by subsidizing energy and food prices, Malta will take longer to ease into the 3% annual deficit target. The Government prefers to bet on the benefits of the multiplier effects from such measures and sees continued subsidies as an investment rather than a cost. In fact, this will be one of the main factors driving the deficit to around €350 million. The second major driver is the government’s pronounced focus on social measures.

Social priority over capital expenditure.

With proposals ranging from increased pensions to the additional Cost of Living Adjustments targeting the lower middle class and lower-income households, the budget has a distinct social orientation. At first glance, this might seem a departure from conventional fiscal tightening measures. However, in an environment where aggregate demand might be threatened by global economic uncertainties, such social measures could stimulate domestic consumption and, by extension, economic growth. The Keynesian premise of boosting aggregate demand during downturns finds resonance here. This means that the government opted to go for the bottom-up approach rather than trickle down economics. The flagship measures of this approach are undoubtedly the increase in the minimum wage and the provision of additional Cost of Living Adjustment (COLA) supplements.

The decision to elevate the minimum wage to €213.54 per week, inclusive of the COLA, from January 2024 is a step towards mitigating wage disparity. This change marks a notable increase from the current €192.73 per week, in a push towards a more equitable wage structure. Notably, the wage is set to further rise annually until 2027, indicating a sustained commitment to improving workers’ earnings. Such a policy, by lifting the lowest wages, directly combats income inequality and supports the purchasing power of the lower-income bracket.

The additional COLA supplement, aimed at vulnerable households, further reflects the government’s focus on tackling the rising cost of living, adding more weight to the redistributive approach. The Malta Budget 2024 sees the expansion of this supplement to cover 95,000 families, up from 45,000, underscores the government’s recognition of the widespread impact of inflation on living standards. This measure ensures that workers in the lower middle class and lower class are protected against the erosion of purchasing power due to inflation.

However, this approach is not without its critics, with business lobbies arguing that higher minimum wages can lead to increased labour costs for businesses, potentially impacting hiring decisions and cost structures. They argue that this may disrupt the balance of the labour market and the competitiveness of the economy.

That said, there are inherent risks to this approach. With a priority on the social aspect, there will be a tightening in expenses on capital projects on the horizon. This means that the only projects that will be undertaken will be those benefitting from EU funds. These are capital projects that Malta must undertake so as not to lose any EU funds (€2 billion allocated to Malta for the next 5 years) increasing the pressure on Chris Bonett, whose remit is to oversee the allocation and management of EU funds.

Furthermore, Malta Budget 2024’s limited focus on capital expenditure means that there is a reduction on environment-oriented infrastructure. This contrasts with the previous launch of Project Green, raising eyebrows. With €700 million pledged for urban greening projects, one would expect a more aggressive allocation in this budget. The delay suggests that significant environmental investments might be backloaded, scheduled for the latter stages of this government’s tenure.

Malta Budget 2024 lacks of measures to address aging demographic challenges.

While robust in addressing various socio-economic challenges, this year’s budget appears to overlook crucial demographic trends. The Malta Budget 2024 response to these demographic challenges could be better in view that this a core problem to Malta’s economic challenges. While interviewed by the Times of Malta, the Minister acknowledged that the numerous concerns about the size of the foreign population raised by many Maltese are a result of demographic challenges.

With low fertility rates and ageing population, one would have expected a more serious discussion on the matter. Malta’s budget could have included more agressive measures such as tax incentives for families with children, or even heavy direct financial support per child, akin to policies in other EU countries such as Hungary. These incentives not only encourage higher birth rates, but also support the overall well-being and economic stability of families and child rearers. There’s a clear need for a comprehensive, long-term demographic strategy that goes beyond immediate fiscal measures, encompassing broader societal, cultural and economic incentives to encourage and enable young families to have more children.

Tackling school leaving rates

As outlined in the pre-budget document, the Malta budget 2024 introduces a notable focus on enhancing education, particularly targeting early school leaving rates and promoting tertiary education, in an effort to cultivate a skilled workforce suited for a knowledge-intensive economy. The standout initiative in this pursuit is the introduction of a €500 tax credit for each child that continues into post-secondary education, a measure aimed at supporting families across all income levels. Particularly impactful for families from lower educational backgrounds, where dropout rates are traditionally higher, this policy attempts to alleviate financial barriers and encourage a broader appreciation of the value of prolonged education.

While the tax credit provides direct financial aid, its broader implications include altering perceptions around the importance of higher education in communities where it has not been historically emphasized. For the policy to be even more effective, it needs to be part of a larger strategy that includes mentorship, career guidance, and additional educational support. By addressing both the immediate financial concerns and the deeper cultural attitudes towards education, the government aims to foster an environment where academic achievement is not only accessible but also valued and pursued by all sectors of society.

Sources

What Malta’s education system learn from the Estonian model

Minimum wage set to increase gradually over the next four years

Leave a Reply